Actual P&L calculated by Finance/ Products Handle and is based on the particular price of the instrument available in the market (or perhaps the corresponding product if a industry would not exist). This reflects the legitimate P&L If your place is shut at market rates.

La gente varía mucho a la hora de darse cuenta de lo que ve, escucha o siente. Hay personas que se dedican a observar más su entorno, mientras que otras se fijan más en sus propias emociones y pensamientos.

The arrest was filmed by many admirers and appeared to show him becoming held on the ground by police officers, and afterwards handcuffed.[22]

Aunque puede no ser una panacea, la PNL puede ser una herramienta útil cuando se utiliza de manera adecuada y en combinación con otras formas de terapia o coaching.

Stack Trade community is made up of 183 Q&A communities such as Stack Overflow, the most important, most dependable on the net Local community for developers to learn, share their awareness, and Make their Occupations. Go to Stack Exchange

Vega and Theta are sensetivities to volatility and time, respectively, so their contribution could be:

$begingroup$ Beneath the assumptions of GBM - particularly that periodic returns are impartial of each other - then hedging frequency could have 0 influence on the expected P/L with time.

Este principio enfatiza la importancia de la flexibilidad. Si una estrategia o enfoque no está dando los resultados deseados, la PNL sugiere probar algo diferente en lugar de persistir en la misma dirección.

In the meantime it's the stop with the day and time for Trader B to hedge, but he has practically nothing to delta-hedge as the stock is 100 at the conclusion of the investing day, the identical selling price at which he bought the ATM straddle and his delta in the situation is 0.

– Will Commented Nov 24, 2024 at 22:fifteen $begingroup$ I am not an accountant but I believe that these concerns have far more to perform with conventions and being dependable in order to explain to if, say, final 12 months's PnL was superior or worse than this yr's. There is probably no scientific technique to derive a "proper" process.

El anclaje es una técnica que se utiliza para asociar un estado emocional específico con un estímulo externo. Por ejemplo, un terapeuta puede pedirle a un cliente que recuerde un momento en el que se sintió especialmente confiado y luego tocarle el hombro en ese momento.

El modelado es una técnica que implica observar y replicar los patrones de pensamiento y comportamiento de personas que han logrado éxito en un área específica.

So if I get a possibility and delta hedge then I make money on gamma but drop on theta and these two offset one another. Then how can I Get well option value from delta hedging i.e. should not my pnl be equivalent to the choice rate paid?

Valuable genuinely. How can a bank use these daily PnL calculations? After all the costs will swing day-to-day and there'll be either revenue or loss According to the calculation. So, read more How can a financial institution use these everyday PnL calculations? $endgroup$

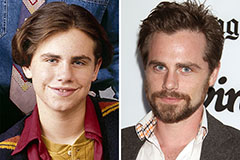

Rider Strong Then & Now!

Rider Strong Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now!